Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a director of operations who makes $120,000 per year and spends some of her money this week on healing herbs from her acupuncturist.

Occupation: Director of Operations

Industry: Hospitality

Age: 29

Location: Houston, TX

Salary: $120,000

Net Worth: $364,000 (Roth IRA: $49,000, Individual Fidelity Account: $27,000, HYSA: $32,000, Vanguard: $7,000, checking accounts: $10,000, I bond: $10,000, Savings Bonds: $4,000, House: $600,000 (minus $150,000 mortgage, divided by 2). My partner, G., and I live/own our home together but keep all of our finances separately.

Debt: $150,000 mortgage (we split this, so I owe $75,000)

Paycheck Amount (biweekly): $3,350

Pronouns: She/her

Monthly Expenses

Mortgage/House Expenses: $1,800 (My portion of all house-related payments (mortgage, taxes, utilities, wifi, etc.).

Loans: $0 (I paid off my student loans ($30,000) when I turned 25. I drive my fiancé’s dad’s old car.)

ClassPass: $78

Spotify: $10.81

Apple One: $32 (my mom uses all the perks of this too.)

Peacock: $4

NYT Cooking/News: $4 (my first year ends next month and this will increase to $15/month.)

Streaming Services: paid by family or partner.

Phone Bill: Paid by mom (in exchange for my Apple subscription.)

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I don’t think there was ever a conversation about it, but I expected it of myself. I was always very driven to be a great student and worked very hard to attend the best possible school I could. Looking back on it, I wish I cared less about the prestige of a fancy public college and had gone to a public university to save money. My parents never pressured me, but were willing to support me in what I was trying to accomplish. I paid for college with a combination of my parents, grandparents, a scholarship I received from my high school, and student loans. I worked my junior and senior year of college for fun spending money and my parents paid for my room and board, books, and food.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My mom taught me about finances from an early age. My parents divorced when I was young and it was just my mom and me. She taught me to never rely on anyone else or spend more than what I had. I would save my money in a wallet and she taught me about interest payments and investing money. My mom was very open about finances.

What was your first job and why did you get it?

My first official W2 job was working at a burger restaurant in high school. I was a babysitter and camp counselor as well. The job at the restaurant was for a few reasons: I really wanted a car but needed a real reason to get one. I told my mom if I had a car, I could get a job. I got the car and then got the job so I could use it as experience for college applications as well.

Did you worry about money growing up?

Not really. I knew we weren’t the richest family in the neighborhood, but I never really wanted for anything or worried about meals, clothes, or anything like that. My mom worked a full-time job my whole life and she taught me that hard work will get me ahead in life.

Do you worry about money now?

No I don’t. I’m really fortunate that my fiancé is a financial planner. He spends his day helping other people invest in the future, so if I didn’t get a good enough financial education as a child, I certainly do now! He helps me manage all of my financial accounts and has planned our future out (including early retirement, summer camp for future children, their colleges, etc.)!

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself when I graduated college at 21. My mom still pays my phone bill, but she kicked me off of her insurance the minute I got a full-time job! Aside from my phone bill, I’ve covered everything else on my own. I have solid savings for a financial safety net, but I know my fiancé also would be able to support me as he has a great job as well. In a dire situation, we could go live with either of our moms and be totally okay for a while.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received $20,000 total from my maternal grandma for college ($5,000 each year). She also helped me buy a car in 2016 (I’ve since sold this car to my cousin so I don’t count it as passive income because anything I made from the sale I gave back to my grandma).

5:30 a.m. — Wake up and get ready to cycle! We were gifted an at-home SoulCycle bike during the pandemic and I love it! My favorite instructor is teaching at 6:30. I make G. breakfast to take with him to work, drink a glass of water with some apple cider vinegar, and get ready to ride.

7 a.m. — Shower (hair wash day!), blow dry my hair, wash my face, and do a full skin-care routine (Sunday Riley cleanser, vitamin C serum, eye cream, moisturizer, and some Unseen sunscreen). Throw on a DKNY dress with booties from Target. Grab a green juice I bought yesterday at yoga and out the door.

9 a.m. — Get to my first stop of the day. I have five locations in Houston so I stop by the first restaurant/bakery to check in on them. Being in the restaurant industry most of my career really pays off as I hardly ever have to buy breakfast/lunch for myself. All of my meals are paid for as comps when I’m working. I get an iced matcha americano and answer some emails. I check on how the products look for the day and make sure my managers are feeling good as we start to get busier. I also sip on my green juice. I don’t usually eat anything until about 11 (just when I get hungry) but I do my best to stay very hydrated.

10 a.m. — Drive over to our commercial bakery for a meeting. I meet with our two bakery managers. I spend the next hour or two reviewing our financials and comparing them against our projections and our previous year’s sales. The restaurant industry was hit hard during COVID and I’m so fortunate that our owners pushed through to stay open and keep us employed. I had a lot of industry friends who were out of jobs for months, and luckily for me, I worked harder than I ever had and I didn’t lose a single day of pay. I’m very grateful!

1 p.m. — Meet up with two of my managers for a work lunch at one of our restaurants. I try to use lunch as a meeting time that is more fun than just sitting in a room. When we do lunch meetings, we order a bunch of food from the menu to evaluate and also get work done. It’s also a good time to check in on my managers and see how they’re doing and make sure everyone is feeling supported. We get two salads, a sandwich, a burger, and fruit as sides to “taste test.” Sometimes I really love my job.

4:30 p.m. — Check in on my last two locations for the day. Everyone seems to be rocking and rolling and ready for a solid Thursday night of sales.

5:30 p.m. — Stop at Target on my way home. I get a new makeup travel bag for my holiday trip back home, laundry detergent, lint balls for the dryer, two boxes of Goodles Mac & Cheese ($58.43). Then I stop at the nail salon to get a pedicure ($57.60 including service and tip). $116.03

6:30 p.m. — Fold some laundry, tidy the house a bit, and cuddle with our cat. G. gets home at 7 and we make Trader Joe’s gorgonzola gnocchi (everyone needs to try it) with some grilled chicken. We have Thursday night football on in the background while G. looks up old trucks and I play games on my phone. Wash up with my Sunday Riley routine. In bed by 10 for me, G. joins around 11.

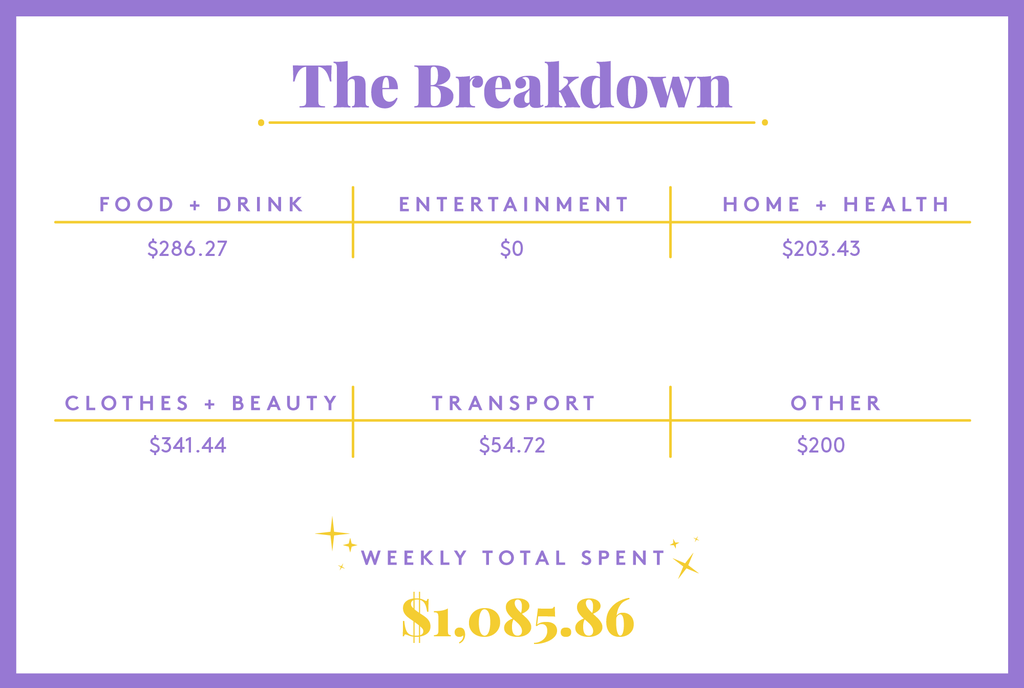

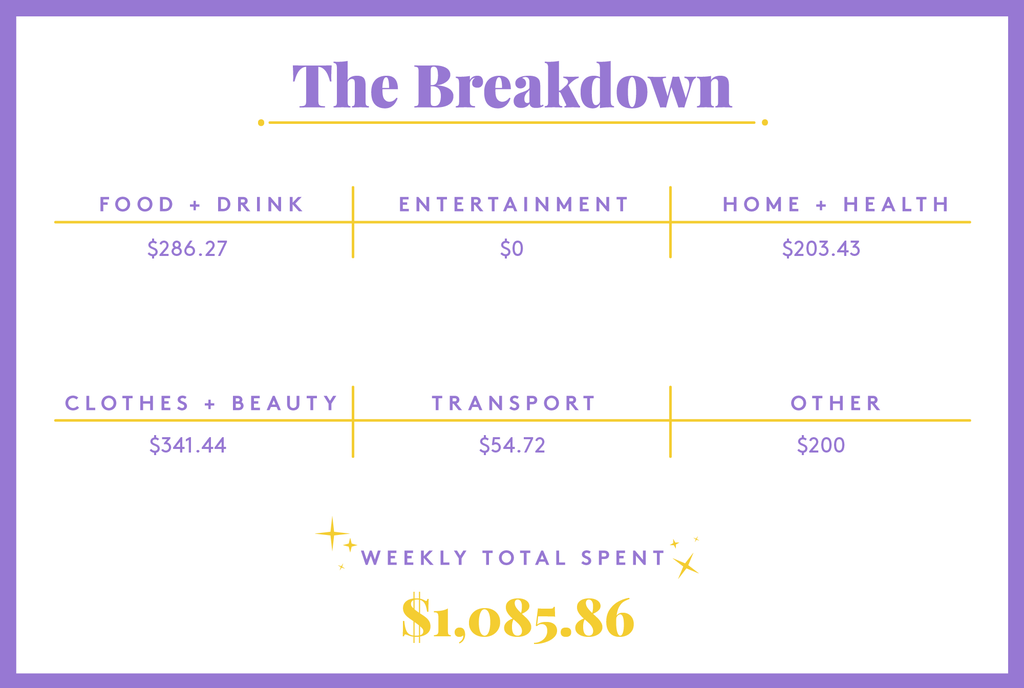

Daily Total: $116.03

6 a.m. — Up a little later today. I do an ab circuit, make G. breakfast to take with him to work, shower, and get ready for Friday!

8 a.m. — I have my weekly therapy video session. I’ve been in and out of therapy since I was five (thank you parents for that!) and truly love having someone to vent to. I’ve been speaking to this therapist for the past two years and it really helps me keep things in perspective. Telehealth is one of the benefits of my health insurance and I highly recommend looking into it! I was previously paying over $200 per session before learning my insurance covers all video therapy sessions!

9:15 a.m. — Get to work and check in on the first round of restaurants. It’s supposed to be a rainy evening so I’m reviewing with managers to make sure they keep their labor in line with their sales.

11 a.m. — I have a coffee meeting with our recruiting and training director. I get a tea and he gets a flat white (expensed). He fills me in on a few new hires and some new managers that just joined our company. We catch up on a plan for the new few weeks with the holidays quickly approaching. After that, I have lunch with our coffee roaster to talk about our launch for bagged espresso and decaf. We share a burger and a grilled chicken sandwich with side salads (expensed).

2:30 p.m. — I go to my wax appointment. I have been getting a Brazilian every four weeks for the past nine years. It is the one thing I do religiously in my beauty routine. I have a wax pass so I only pay tip. $20

3 p.m. — I get an express facial and get peer pressured into signing up for the monthly facial program they offer. It is a good deal as the facial would be $105 and with the monthly membership, it’s only $80/month. I sign up and leave a $20 tip. I consider it a worthwhile investment with my wedding coming up next year… or at least that’s how I justify it. $100

4 p.m. — Back at my last stop of the day to check in on the team going into the weekend. Everyone seems to be ready for a chilly weekend. I drink a mint tea, have a bite of cheese, and finish any last-minute emails. Pack up and head to meet G. at his office.

6 p.m. — I meet G. and we head over to his mom’s house. She got home from the hospital a week ago so we spend some time with her and check to make sure she’s feeling better. We hang out for about two hours helping her get set up for the weekend and cleaning up a bit. G. lost his dad about seven years ago and takes amazing care of his mom, it really melts my heart how much he cares about her.

9 p.m. — While we’re driving home we get into the dumbest of dumb arguments. We end up going straight home and don’t pick anything up to eat. I’m not feeling particularly warm and cuddly so I head up to bed to relax. G. makes himself pizza bagels from the freezer and joins me in bed around 11.

Daily Total: $120

7 a.m. — It’s Saturday and I’m still up early. Slowly wake up and G. and I decide we want tacos. He’s still a little salty from last night so I decide to pick them up while he fully wakes up. I get three tacos ($10.62) and a latte for G. and cold brew for me ($9.50). I decided to walk but didn’t realize just how far I was going. I Uber home ($7.62 but covered with Amex credit on Uber). $20.12

11 a.m. — We have tickets to the Houston Golf Open. I’m not the biggest golf person, but G. loves golf so I’ve started to watch/learn more. We score free VIP passes through his work, which gives us access to free food, drink, and parking! We have a few friends who are also going so we meet up with them throughout the tournament.

4 p.m. — Well that was a full day! Because of the passes, we got free food and drinks all day long (pasta, chicken, fries, open bar, and alllllll the snacks and treats!). We get going as the tournament is wrapping up and head to Walgreens to get G.’s prescription. We go to one Walgreens to find out the prescription is at the other Walgreens so we drive over to that one. We get G.’s prescription, some Fresca (impossible to find and my absolute favorite!), and some gummy vitamins (G. pays).

7 p.m. — We go to a sushi spot with delicious nigiri, handrolls, and sashimi. We each get omakase for $55 plus some sake and a few added pieces of nigiri. Total is $150 and G. pays (I Zelle him my half). We end up talking to the couple next to us and then going to the bar next door and grabbing a drink so we can continue the conversation. G. buys the round of drinks. $75

10 p.m. — We stop by a friend’s birthday, very late due to our extended dinner. G.’s friend hands him a beer as we walk in and we socialize for a bit. We stay through a cake-cutting and head home by 11:30. In bed as fast as possible.

Daily Total: $95.12

9 a.m. — Wake up and cuddle in bed. I joke, but the reality is we’re morning sex people. We both pass out most nights so we reserve cuddle sessions for the morning. We have the football game on in the background and decide soup would be great on this cold Houston morning. We order French onion soup from a French restaurant ($24.50) and pick that up along with some Pumpkin Spice Lattes from Starbucks to really lean in and enjoy on the couch and cozy up under blankets. I add $25 to my Starbucks prepaid account to cover our two drinks. $49.50

12 p.m. — We finish our soup on the couch and head to our neighbors’ house. We moved into our house in July 2020 and got so lucky that our neighbors are amazing! We hang out with them almost weekly and we’re so fortunate that we met them. We end up hanging out with them watching football and the F1 race until about 4.

6:30 p.m. — We pick up some fried chicken from the best place ever. We have one of G.’s friends coming over to watch football, but neither of us are really in the mood for company. We eat fried chicken, fried okra, coleslaw and baked beans. I pick up the tab ($51.92) and we treat G.’s friend. The boys hang out for a bit but I head up to bed around 9:30. $51.92

Daily Total: $101.42

6 a.m. — Up and do not feel great at all. I’m hoping it isn’t anything bad, but really feels like strep. I spend the morning drinking tea and trying to decide how bad it is. I wake up G. around 7 and he tells me I sound like death and need to go see someone. I bundle up and head to Urgent Care.

9:30 a.m. — Well, two hours and nothing conclusive. The doc tests for strep, COVID, and the flu, and apparently it’s none of those. They give me some shot that they say will help with the swelling in my throat and tell me to drink a lot of fluids and rest. I pay the $75 co-pay and head home. I call my boss and other team members that I have meetings with today to let them know I will be working from home. Being in the restaurant industry means I hardly ever work from home since so much of what I do is in person. I get home, make some tea, and get through my inbox. $75

11:30 a.m. — I remember I have stuff at the dry cleaners. I ask G. if he needs anything since I’m running out to pick things up. I also text my acupuncturist who I was scheduled to see today to tell her I’m under the weather. She lets me know she has some herbs and teas I should take to feel better. I stop and drop off/pick up dry cleaning ($33.29), stop by G.’s office to bring him his drill (not sure what he’ll need that for in his office but he asks for it), and then stop by the acupuncturist to grab the herbs and tea ($70). Seems pricey, but I figure they’ll last and if they kick this nasty virus/cold before I travel Friday to see my family then it will be money well spent. $103.29

1 p.m. — Make a pack of “healthy” ramen and log in to a call. I spend the next few hours on the phone with my boss. The afternoon flies by and by 5:30 G. is calling me telling me he’s on his way home and in the mood for dumplings. Guess it’s going to be an Asian food day.

6 p.m. — Our dumplings, fried rice, and pork buns get delivered and we’re both very happy with our decision to order in. We watch some dumb drama on Netflix and I die laughing at G. who is making commentary about how dumb the show is. I end up getting super tired and we head upstairs around 9:30. Some Chinese herbs and I’m out the second my head hits the pillow. $52.18

Daily Total: $230.47

6:30 a.m. — Up and decide I’m well enough to go to work. I take some DayQuil so I don’t sneeze on people but I truly feel better than yesterday and plan to be responsible about being near people. G. wakes up and we get ourselves together to get out the door at a reasonable time.

8:30 a.m. — Get to my first restaurant of the day and have our usual Tuesday morning meeting. The restaurants I manage are closed on Mondays, so Tuesday is our first big day of the week. We discuss the big happenings of this week and review any issues from last week. I then meet with the manager of the bakery to go over orders for next week. While there, I drink two huge cups of peppermint tea and the kitchen crew makes me a Mexican tea that their grandmas swear by. It has oranges, garlic, ginger, onions, honey, a bay leaf, and some whole peppercorns with water.

11 a.m. — I stop at Costco on my way to the next restaurant to get gas ($54.72). I end up going to the office to check in with the team there and see how everything is. I eat the leftovers that I brought with me around noon and pack up to go over to the second restaurant for the remainder of the day. $54.72

5 p.m. — I meet G. at our house and we drive to a potential wedding venue. We’ve been engaged for a few months and planning a wedding has been very difficult for us. We’re really excited about this venue and the woman giving us a tour is so patient and gives us great information. We end up grabbing dinner in the trendy food hall nearby. We get an African bowl of rice, sweet potatoes, plantains, and chicken as well as a hot chicken sandwich. We start by sharing the sandwich and by the time we finish that, we’re not hungry for the bowl! We get it to go and G. has lunch for tomorrow. We continue to discuss the venue on the way home. $37.55

8 p.m. — By the time we get home, we’re both tired and ready to relax. G. gets ready for bed and I do a little online shopping. I find some items on Amazon that a blogger I liked posted about. Both G. and I are the king and queen of buy and return. I will most likely return almost all of what I buy, but I order a pair of jeans, a button-down shirt, and a sweater vest. Also a pack of socks that I definitely need ($130.55). I wash up, get ready for bed, and we finish The Watcher (did not love the ending). Try to cuddle up to G. for a little sex but he reminds me that I stayed home from work sick yesterday. He promises a cuddle session tomorrow or Thursday. I roll over and he rubs my back as I fall asleep around 10. $130.55

Daily Total: $222.82

5:30 a.m. — Up and I feel well enough for a quick workout. Do a 20-minute lower body pilates workout, which I immediately feel in my glutes and quads. I make G. a breakfast taco with eggs, bacon, and cheese in a flour tortilla and drink a big cup of peppermint tea. I shower, wake up G., and we start to get ready to get out the door.

8:30 a.m. — Do my normal rounds of the restaurants and bakeries. I spend time with each of my managers just ensuring we’re prepared for the week. Most of my job is in-person and G. and I would love jobs where we can be remote for a part of the year to visit family and get away. Neither of us were working remotely when the pandemic started and it’s something we both regret. On the plus side, we didn’t lose our jobs, but we both worked harder than ever during the pandemic.

11 a.m. — Get to the office and heat up my leftovers from Monday night again. Check-in with the CFO and review our budgets for the 2023 year. We have a lot of issues in my opinion, so the accounting team gets back to the drawing board with some of my recommendations. It is a productive meeting and takes up about two hours of my day.

4:30 p.m. — G. and I have a birthday party for one of the managers I work with. She is the sweetest girl who always buys us something whenever she is on a trip. She welcomed me to the company when I started three years ago and she loves G. I stop at a local spa and pick up a 75-minute massage gift card for her. I throw in the tip so she can just enjoy ($200). I usually do not buy things for my managers (I don’t want them to feel favoritism and I have 24 people who report to me among management), but this feels special. I pay fully as she is more my friend than G.’s. $200

5:30 p.m. — The party is just gorgeous. She set it up in the garden of our restaurant and starts with passed apps, drinks, and a huge charcuterie board. Everyone is mingling, there are speeches, and then we sing happy birthday. Some partygoers leave and we move over to a big table for dinner around 8. Tenderloin, mashed potatoes, salads, rolls, and asparagus, and G. and I are stuffed. We leave around 9:30 and head home. G. gets in bed and immediately falls asleep. I do my nighttime routine, fold some laundry, and get in bed around 10:30.

Daily Total: $200

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Los Angeles, CA, On A $240,000 Salary

A Week In New York, NY, On A $180,000 Joint Income

A Week In Portland, OR, On A $250,000 Salary

Original Article Source

Word on the street is that folks believe that romance and yearning are dead. But… Read More

I don't know about you, but whenever summer gets close enough for the temperatures to… Read More

It doesn’t seem like that long ago that our feeds were flooded with images of… Read More

Confused about the new COVID-19 vaccine guidelines for children and pregnant people? Trust us, you’re… Read More

It’s hard to believe summer is here. May felt like it would never end —… Read More

I remember growing up when the most popular high school sports for girls were track… Read More