Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a general manager who has a $59,000 joint income and who spends some of her money this week on protein soda.

If you’d like to submit your own Money Diary, you can do so via our online form. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Occupation: General manager

Industry: Retail

Age: 32

Location: Johnson County, KS

Salary: Was $39,520 a year but I recently got a raise (that just went into effect) to $45,000 a year.

Joint income: Our joint income is about $59,000 (after taxes). That’s a rough estimate since we both got raises and I haven’t figured out what my husband makes yearly yet with his new salary (he’s hourly). We share everything, but I’m the main person that deals with our finances.

Assets: We own a 2022 Kia Sorento Hybrid that we bought for $36,452.

Debt: $21,227 in debt (credit cards and a personal loan).

Paycheck amount (bimonthly): $1,350

Pronouns: She/her

Monthly Expenses

Housing costs: $0. We live with my mother-in-law and we are super blessed that she doesn’t charge us rent or for utilities.

Loan payments: $524.75 for car payments; $302.98 for Sallie Mae loan; $320.63 for a personal loan through SoFi; $310 debt management plan.

Daycare: $1,800 a month for our three girls.

Cell phone: At the moment we don’t pay anything. We’re on my family’s plan and my parents are letting us get the debt under control before we start paying again.

Subscriptions: $168. This includes: Apple One (I pay for me, my husband, my MIL, my dad, my mom, and my sister); Amazon Prime (me and my MIL, as well as my husband, but he doesn’t really use it); Amazon Kids+ (this is so our three girls’ Kindles can have the Amazon Kids library — we don’t have to buy individual apps that way); A Color Story (this is a photo editing app that I’ve been using for years and will use occasionally for work); Adobe Lightroom (I started a Bookstagram account a couple months ago and I use Lightroom to edit photos. I also use it occasionally for work); Xbox Game Pass (my husband loves video games and this has kept us from buying multiple games a month); Canva (I use this to help make designs for my Redbubble and graphics for my Bookstagram); MLB At Bat (I pay once a year to have access during the season and I love it); Hulu/Disney+ bundle (we had the legacy bundle (Disney+ without commercials) but we recently downgraded to the more basic plan because it was so much cheaper. Now our Disney+ has commercials but we save money).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There was always the unsaid vibe that we needed to go to college and I did go to college. I went to Pittsburg State University in Pittsburg, KS. I took out student loans for most of it, but my parents paid for my last two semesters.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

There was pretty much no talk about finances and we didn’t really start talking about money until we started planning for my wedding. Even now, it’s still not a lot. I was taught how to do my own taxes and I took a personal finance class in high school, but that was about it.

What was your first job and why did you get it?

My first job was working at a local theme park called Worlds of Fun. I got hired for seasonal work (they pretty much hired anyone since it was a theme park). My first “adult” job was at a local wholesale printer in the KC metro. I worked there for about six and a half years in the layout area of their graphics department. I approached them about moving to their customer service department and getting a raise but then I got the job that I’m currently at, which is a much better job, so I left.

Did you worry about money growing up?

No, but that’s because I didn’t know what was going on with it. Even now, I don’t like talking to my parents about money. It usually will cause me more anxiety about my own finances and I will normally end up in tears because my mom doesn’t get that $32,000 a year in 2024 isn’t the same as $32,000 a year in the 1990s.

Do you worry about money now?

All the time. It’s pretty much always on my mind and I’m constantly thinking about money and how we can afford things. I don’t think there’s a day where I haven’t thought about money at least once an hour and wondered, How are we going to pay for this? or How are we going to do this? I seriously hate that money has become all-consuming, but when you only make about $59,000 a year with a joint income with three kids, money is going to be your main concern.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I haven’t yet and I absolutely hate to type that. But I am not financially responsible. We are working on it! And doing what we can to get us in a better spot. Both me and my husband are taking the steps to figure out what we need to change and what we can do. We’re also leaning into the fact that we can’t always do all the things our friends are doing. That was a big issue for us several years ago. We both would get bad FOMO. Then we’d spend too much on a night out or a trip and we’d have to ask our families for money. We hated it, but we’ve learned how to deal with it and how to keep ourselves from going down that road again.

Do you or have you ever received passive or inherited income? If yes, please explain.

I have a Redbubble shop where I have uploaded designs and people can buy different types of products with those designs. It’s been live for about a year and I’ve only made about $98 so far.

Day One

6 a.m. — The first thing I wake up to is a payment to Zip4Pay. Trying to buy $200ish worth of diapers and wipes at once is honestly a pain and we prefer to have it broken up so we use Zip4Pay. $17.26

9:15 a.m. — I stop by QuikTrip to grab a couple energy drinks (Reign REIGNbow Sherbet and C4 Jolly Rancher flavors are my favorites), snacks for the day (Cheez-Its and Doritos), and a protein shake. I shouldn’t have come into the gas station while I’m super hungry — I’ve bought way more than I should have. $19.75

1:30 p.m. — It’s time to eat lunch. I made a tortellini bake at the beginning of the week and have been eating it all week for lunch. It’s such an easy thing to make and you make a lot, so you can eat it for dinner one night and get a lot of leftovers. I found the recipe on Pinterest and adapted it to what I know my family likes.

3:35 p.m. — Apple One gets deducted from my account. I pay for myself, husband, parents, and mother-in-law to have the Apple subscriptions. Our Apple One includes music, Apple TV, Apple Arcade (I use it way more than I thought I would), and iCloud+. When my husband and mother-in-law switched to iPhones, we did the math and realized it would be so much cheaper if the five of us did one giant plan, rather than everyone subscribing on their own, so I decided to be the main person for subscription. $25.95 (included in monthly expenses).

5:13 p.m. — I go by QuikTrip again to grab a fountain drink and protein shake because I am now addicted to protein sodas (root beer + Fairlife Core protein shake = amazing). $8.45

5:55 p.m. — I swing by the dispensary for my husband to pick up his order. $43

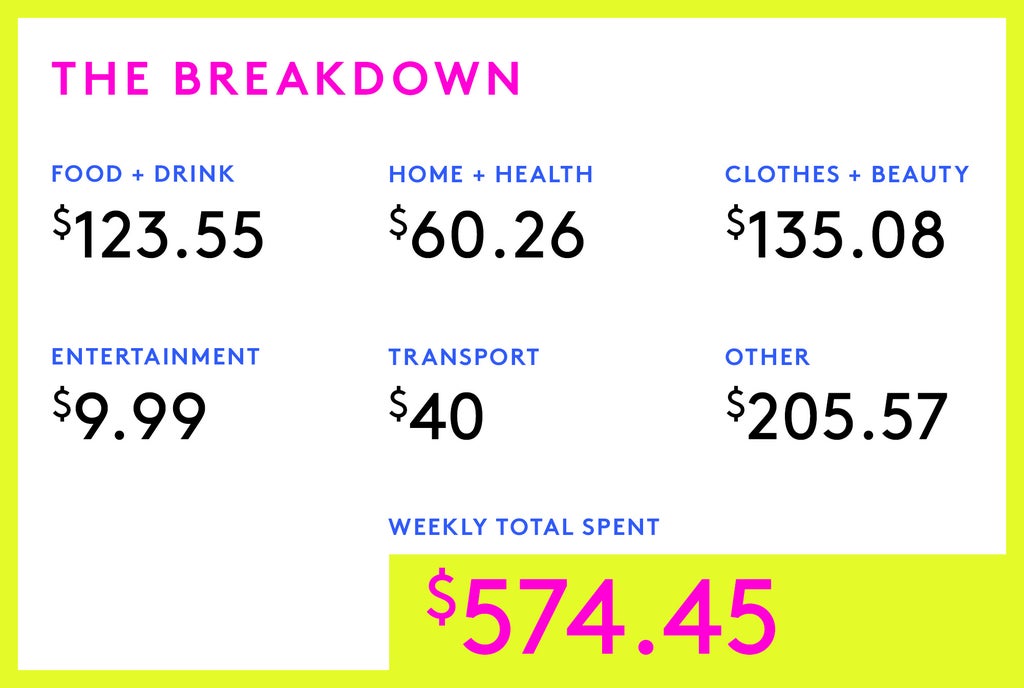

Daily Total: $88.46

Day Two

8:30 a.m. — Our personal loan payment needs to be paid and, unfortunately, we’re paying it late because our expenses got a little out of whack last paycheck. Luckily, SoFi hadn’t charged us a late fee for the payment. $320.63 (included in monthly expenses).

9:04 a.m. — With the season changing (and a forever-changing body), I need new clothes. Luckily I have a coupon for Abercrombie and I’m able to find the jeans I want in my size (it’s hard to do). I end up using Afterpay to break it up. I know that these four payment plan things aren’t the best, but sometimes they really come in handy if we are needing to buy things but we have some other needs. $20.44

9:17 a.m. — It’s bonus day at work! We’ve met the sales goals at both stores and I get $375 for my bonus. Because of this, I do a little “treat yourself” thing and grab Sonic for breakfast. My normal order is a dirty root beer (minus the lime) and popcorn chicken. I think Sonic might be one of my food hyperfixations right now. Sometimes my food hyperfixations can get out of hand and I will eat them for breakfast, lunch, and dinner — unfortunately, it’s only gotten worse since having kids. Pregnancy really messed up my appetite and eating habits. $10.54

11:20 a.m. — I buy an Apple Watch band. We got them in at work and I’ve been wanting to buy a similar one so I decided to wait and use my 50% discount. The band is adorable and it goes with everything. Plus I love the mixed metal look it has. It makes my watch look less like an Apple Watch. (Note: Andi is the brand.) $13.75

2:04 p.m. — I’m doing really well with bringing my lunch this week and today is no different. It’s the last day I’m able to eat the tortellini bake. I plan on making it again because of how many meals we were able to get out of it (three for dinner the night it was made and then a week of lunches for me).

4:57 p.m. — I get some boba tea from the local boba shop — another “little treat” because I’m awesome. I decide to try one of their fall speciality drinks and it’s pumpkin pie flavor. It’s really good. $8.36

5:35 p.m. — This is another “treat myself” moment: I buy some earrings from the store I manage. Both pairs of earrings are gold filled and I have been eyeing them since we got them. $36.61

Daily Total: $89.70

Day Three

10 a.m. — We need to buy our Halloween costumes and all three of our daughters’ costumes. Since I’m ordering online, we use Zip to break it up. My husband is going to be Ghostface and we have most of his costume already on hand, we just need to get the mask. For the girls we are going to get Disney princess and Minnie Mouse dresses and (bonus!) they can wear them again. $37.76

3:30 p.m. — Our daughters are currently potty training and they are all having great days so we talk about it and come to the decision to get them a reward. The oldest is getting a Barbie she was really wanting and our twins are going to get Cry Baby dolls. $35.84

8:20 p.m. — There is a baby sprinkle tonight for our friends and their second baby. We load up the kids and head over to their house to celebrate. On our way home, I need some food so we make a pit stop at Sonic. We order a medium popcorn chicken, a “witch’s brew” slush float, and a large dirty (without the lime) root beer. $13.06

Daily Total: $86.66

Day Four

9:13 a.m. — I need to get gas for the week and I also need a root beer and a Fairlife protein shake (I told you, my one food hyperfixation right now is protein sodas). I have a hybrid SUV, which means I only have to fill my car up once a week, and with gas being on the lower side right now, it only costs me $40 to fill up my car. $48.56

1:10 p.m. — I’m working at the bookstore today. I was lucky enough to get the opening shift, which means I can get home early and spend the day with the kids. I don’t feel like trying to figure out lunch once I get home, so I get all of us McDonald’s on the way. The most expensive part is the Happy Meals. When in the world did Happy Meals become so expensive? I get three and it’s most of the cost! Me, my husband, and my MIL all get the $5 meal deal they currently have (burger or chicken sandwich, four nuggets, small fries, and a drink). $32.95

Daily Total: $81.51

Day Five

8:15 a.m. — My payment for my Target RedCard was due yesterday but I only just realized and now I have to make the payment late, which means my payment next month will be a bit higher and I absolutely hate that. I think the late fee will be $15ish. So not much, but not ideal. $58

11:30 a.m. — The payment for our debt management plan came out today. We made the decision to enroll in the plan to help get our credit card debt down and get out of it faster. It’s honestly helped us so much over the last couple months we’ve been in the program. Both of our credit scores have gone up and our debt is going down. It has made me realize how much we were relying on credit cards. $310 (included in monthly expenses).

1:17 p.m. — The EarnIn payment comes out. We hate using EarnIn but we needed to use it last paycheck because, like I said earlier, our finances got out of whack. Personally, I think EarnIn can be pretty helpful when you need it, but I can also see how it can be bad for some people because you could fall into a cycle of borrowing one check, paying it back, then needing to borrow again because you’re low on money, and just having that repeat over and over. $111.73

1:45 p.m. — I’ve brought my lunch again! I made a gnocchi bake last night.

5 p.m. — My husband makes our payment to our daycare provider (we pay weekly). The girls go to an in-home daycare that is run by a family friend and it’s $90 a day for all three of my girls (so $30 per child). This will be changing soon since the oldest is going to start preschool so we will be paying $615 a month for three days to the preschool and then we will be paying daycare $360. It’ll end up costing us a little bit more per month than we are paying right now, but once the oldest is fully potty-trained we’re going to send her to preschool full time, so the monthly total for childcare will balance back out. $450 (included in monthly expenses).

6:05 p.m. — We get in some new custom jewelry that my mother-in-law and I have been waiting for, so I buy a ring with the profile of Andy Reid on it for her and two bracelets for me (one has KC landmarks and the other has illustrations of Patrick Mahomes, Travis Kelce, Andy Reid, and the Chiefs mascot). $26.52

6:18 p.m. — I make a last-minute decision to get a cake from Nothing Bundt Cakes because it was a busy, long day and I need something sweet. I get their chocolate chocolate chip — it’s my favorite of their cakes. $7.12

Daily Total: $203.37

Day Six

4:40 a.m. — The book I preordered is finally released! It’s The Wedding Witch by Erin Sterling and it’s on my Kindle. I try to support the local bookstore I work at, but I’ve had this book preordered for a while and (honestly) had forgotten about it. Plus, reading on a Kindle is so much easier when you have kids because you can just toss it down really quick when you need to break up a fight or if you need to help them with something. I still love physical books, but I love my Kindle just as much. $9.99

2 p.m. — I’ve brought leftover gnocchi bake to work for my lunch again. While I eat, I work on purchase orders for the store and I help a couple of customers who come in to grab some Royals accessories. I also make sure to have most things done before I leave tonight because I’m going to be taking a half-day tomorrow to go to the ALDS game at Kauffman Stadium.

Daily Total: $9.99

Day Seven

1:30 p.m. — Still eating that gnocchi bake. That thing is so good and it makes great leftovers. Luckily today is a slowish day (foot traffic-wise), which means I get to eat my lunch and work on helping the store owner with buying for the stores. These are some of my favorite days of work because I just get to shop and look at so many cute things.

8:40 p.m. — I get to go to game three of the ALDS at Kauffman Stadium. My dad is kind enough to pay for my ticket, our parking, and my first drink. I pay for my second drink (my dad doesn’t want one). Going to MLB postseason games is somewhat of a tradition for me and my dad. During the Royals’ run in 2014 and 2015, we went to four different games over those two seasons. $14.76

Daily Total: $14.76

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Los Angeles On A $154,000 Joint Income

A Week In Tampa On A $154,000 Joint Income

A Week In Boston On A $70,000 Salary

This article was originally published on refinery29.com.